The Best ETF Ideas for 2016: Income

First off, I hope you had a fantastic Thanksgiving celebration! I love this holiday, and I hope it was good for you and your family and friends.

We have a lot to be thankful for in America. Despite the downbeat headlines around the world lately, we always must remember that we enjoy a standard of living greater than any time in human history. For that blessing, I am thankful.

I am also immensely thankful to you, the Weekly ETF Report reader, to subscribers to my Successful ETF Investing newsletter and to clients of my money management firm, Fabian Wealth Strategies. Without you, what we do here wouldn’t be possible.

Now, recall that last week we covered what I called the best exchange-traded fund (ETF) ideas for 2016, particularly if you are a growth investor.

Today, it’s all about the best ETF ideas for income. But first, let me give a quick review of the growth names we covered last week.

Here’s my list of the five best ETF ideas for growth investors in 2016. Some of these we currently own in the Successful ETF Investing newsletter, and some are just on our radar.

1) Health Care Select Sector SPDR Fund (XLV). Healthcare is an industry that continues benefitting from demographics, innovation, mergers and acquisitions (M&A) and insurance mandates. XLV is the ETF that holds the biggest and best healthcare stocks around.

2) First Trust Dorsey Wright Focus 5 ETF (FV). This is a “fund of funds” that simultaneously holds other funds that have allocations to top-performing sectors. Biotech, Internet, consumer staples, consumer discretionary and healthcare all are part of this fund.

3) PureFunds ISE Cyber Security ETF (HACK). This is the cybersecurity stock ETF, one that we’ve written about extensively in this publication, as well as in the Successful ETF Investing newsletter. We also recently conducted a FREE webinar on HACK, which I encourage you to check out before you start making investment decisions in 2016.

4) iShares India 50 ETF (INDY). India is a country that has a pro-capitalist political climate, a huge amount of human capital and citizens hungry for economic growth and an enhanced living standard. INDY is a way to get exposure to the companies benefitting most from these trends.

5) WisdomTree Japan Hedged Equity Fund (DXJ). Japan continues to put the pedal to the metal on “Abenomics,” which means more quantitative easing from the Bank of Japan and likely more upside for Japanese stocks. And, with DXJ’s hedge component, you get that performance without the negative influence of any currency disparities.

When it comes to growth in 2016, these are the funds I think represent great ideas going forward.

As for income ETFs, there is no shortage of great ideas as we enter 2016. The elephant in the room of a likely rate hike by the Federal Reserve in December will dominate the income landscape, but it won’t alter the picture when it comes to ways to generate yield from your assets.

Here are my five best ETF ideas for 2016 if your primary goal is generating income.

1) SPDR DoubleLine Total Return Tactical ETF (TOTL). This bond fund is actively managed by the “New Bond King,” Jeffrey Gundlach of DoubleLine Capital, and it takes advantage of the best bonds in the market. The fund invests across global fixed-income sectors with an eye toward shorter-duration bonds.

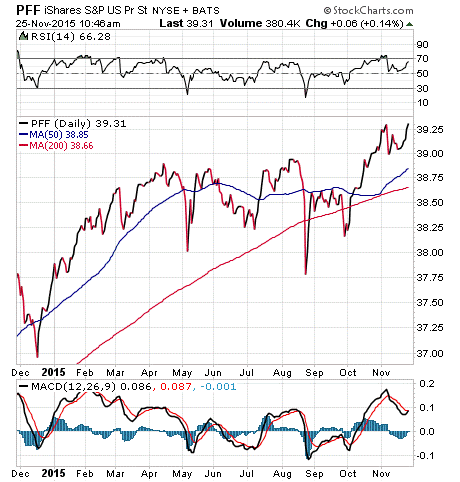

2) iShares US Preferred Stock (PFF). This fund gives you exposure to the best preferred stocks in the market. These hybrid securities are sort of like stocks and sort of like bonds, as they tend to move higher with the equity markets while also delivering strong yields.

3) PowerShares CEF Income Composite ETF (PCEF). This ETF “fund of funds” gives you exposure to the closed-end fund market. That market consistently has delivered outstanding yields for income-oriented investors.

4) iShares US Real Estate ETF (IYR). Real estate investment trusts (REITs) are a fantastic tool for generating yield. In this fund of funds, you get broad-based exposure to the best REITs operating in the market today.

5) iShares Select Dividend ETF (DVY). This is the best ETF for exposure to the biggest and arguably the best dividend-paying stocks in the market today. DVY gives you a very solid yield along with the upside potential of the broader equity markets.

If you want more ideas, including which funds we’re buying right now, then I invite you to check out my Successful ETF Investing newsletter today!

ETF Talk: This ETF Covers the Economy’s Basic Building Blocks

The industries covered in SPDR Materials Select Sector ETF (XLB) provide the inputs needed by a wide variety of other companies. The exchange-traded fund (ETF) holds a span of large companies that initially harvest and process different materials from nature, as well as provide other services necessary for more intermediary and consumer-facing companies to function.

All products must begin somewhere; this sector reflects the beginning of the production process for many final goods. Subsectors found in the index this fund tracks include producers of chemicals, metals, paper and construction materials, among others.

View the current price, volume, performance and top 10 holdings of XLB at ETFU.com.

The performance of this fund thus far in 2015 has been less than stellar, as it has declined by 5.48%. Though XLB outperformed the S&P at the beginning of the year, it fell behind in June and has not made up the difference since. The dividend yield, at just over 2%, more than covers the 0.14% expense ratio and offers a bit of extra incentive for investors. Currently, XLB’s assets managed come to about $2.1 billion.

The top 10 holdings of XLB make up about 67% of its assets. In terms of subsectors, chemical companies are the most important aspect of the sector, as a component of the S&P, by a wide margin.

XLB’s largest individual holdings are Dow Chemical Co. (DOW), 11.75%; E.I. du Pont Nemours and Co. (DD), 11.52%; Monsanto Co. (MON), 8.02%; LyondellBasell Industries NV (LYB), 7.73%; and Praxair Inc. (PX), 6.28%.

If you believe that the time is coming for this sector to rebound and make up for its underperformance soon, then SPDR Materials Select Sector ETF (XLB) may be a strong way for you to play it.

View the current price, volume, performance and top 10 holdings of XLB at ETFU.com.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

6 Questions to Ask Before You Buy Any ETF

I often am asked by readers, radio show listeners and clients about exchange-traded funds (ETFs). Why I like them so much, why they are better than mutual funds, why I prefer them to individual stocks, etc.

Today, I am going to provide a few questions for you, questions you should ask yourself before you buy any ETF.

Here is my list of the six key questions you must ask before you commit your investment capital to an exchange-traded fund.

1) Why am I buying? Do you need to generate growth from your assets, or is income more what you are looking for? Are you buying this ETF for a long-term hold, or do you plan on trading the fund? The first question of why you are buying is all about you and your goals, so the more defined your objectives are, the better your outcome is likely to be.

2) What asset class am I buying? Is this ETF an equity (stock) fund, or is it a bond fund? Is it pegged to a specific market sector, or is it an inverse fund? Knowing what you are buying is critical, so make sure you are fully aware of what’s in that ETF.

3) What index is my ETF following? Is your ETF exposed to the S&P 500? Is it pegged to the Dow? Or, is it pegged to the NASDAQ 100? All three funds of this sort are broad-based equity funds, but they are not created equal in terms of composition and diversification. Knowing how diversified you are in a fund is important, and you know that by knowing what index the ETF follows.

4) What’s the cost? How much is that ETF going to cost you? What is its “expense ratio?” If you don’t know how much you’re paying for something, you can’t make a good decision about value.

5) What’s the asset size and volume of this ETF? Are you buying an ETF with a lot of liquidity and a lot of trading volume? Or, are you looking at an ETF with little assets under management and one that trades low volume. The answer here can make a difference when it comes to efficient trade execution and fund pricing, so be aware of the size of the ETFs you want to buy.

6) What’s my exit point? Do you know when you’re going to sell this ETF? How much downside can you handle? When will you take your winnings off the table? Only you can answer these questions based on your personal investing situation, but answer them you must if you want to be an efficient, and successful, ETF investor.

Finally, recently subscribers to my Successful ETF Investing newsletter received the first new domestic equity buy signal in some time. If you want to find out what we’re buying, then I invite you to check out the newsletter today.

Thanksgiving Humor

“Vegetables are a must on a diet. I suggest carrot cake, zucchini bread, and pumpkin pie.”

— Jim Davis

If you are like most Americans, today you are probably feeling just a little guilty about the extra calories you consumed yesterday. While I certainly can sympathize, it’s also helpful to keep a little humorous perspective about the situation. Here, cartoonist Jim Davis (of Garfield the cat fame) provides the requisite laughter we all should keep in mind.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about my best ideas for growth investors in 2016. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian

Pages

- “A Golden Vision for 2020” Conference Call 2/4/20

- About Doug Fabian’s Mutual Fund Lemon List

- About Eagle

- About Intelligence Report

- About Jim

- About the Money Charts

- Advertise

- Calendar

- Celebrating another year of success together!

- Common Functions

- Contact Us

- Disclaimer

- Disclosures & Disclaimers

- Doug’s Mutual Fund List is Arriving in 2014

- ETF Investing Articles

- Fabian’s FREE Video Series: How to Super-Charge Your Returns Using ETFs

- FAQ

- Fast Money Alert

- Follow Dick

- Get a Quote

- Getting Started with Intelligence Report

- Gmail and Hotmail Email Guidance

- Gmail and Hotmail Email Guidance for Subscribers

- Help with Successful Investing

- IC co-reg

- Important Concepts

- Instructions for AOL Users

- Issue Archive Links

- Jim Woods Investing

- Jim Woods’ Successful Investing Welcome Series

- Legal Footnote for Issues

- Login

- Login

- New Issue Notification

- Privacy Policy

- Processing Login

- Registration for this Publication is Closed

- Resources

- Retirement Compounders

- Special Reports

- Successful Investing September 2014 — FREE Issue

- Symbol Embed

- Terms of Use

- TERMS OF USE AND CONDITIONS OF SALE

- Testimonials

- Testimonials

- Thank You

- Thank You For Signing Up

- Thank You For Updating Your Information

- Unsubscribe

- Update Credit Card

- VIDEO #1: The 6 Categories of ETFs You Should Know About

- VIDEO #2: Concentration for Big Profits

- VIDEO #3: Out of Favor ETFs

- VIDEO #4: Leveraged Exchange Traded Funds

- VIDEO #5: Options 101

- Video #6: Options 201 Enhanced Securities

- Video Series: How to Super-Charge Your Profits using ETFs

- Web Tour

- Welcome to JimWoodsInvesting.com

- Woods’ Wealth Alliance

- Yerbaé Brands Corp, OTC Company Profile

- Your Account

Archives

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

Categories

- Aggressive (4)

- Eagle Eye Opener (1)

- ETF Trader's Edge (78)

- FAQ (2)

- Hotlines (68)

- Recommendations (7)

- Special Reports (1)

- FAQ (18)

- High Velocity Options PLUS (6)

- Intelligence Report (685)

- FAQ (8)

- Hotlines (367)

- Newsletters (229)

- Portfolio & Mutual Funds (6)

- Special Reports (71)

- Prime Movers (4)

- Publications (4,318)

- Bullseye Stock Trader (390)

- Crypto & Commodities Trader (32)

- High Velocity Options (199)

- Successful Investing (1,523)

- FAQ (14)

- Hotlines (1,085)

- Income Multipliers Portfolio (20)

- Consumer Discretionary (2)

- Consumer Staples (2)

- Energy (1)

- Financial (2)

- Healthcare (2)

- Industrial (5)

- Information Technology (2)

- Materials (1)

- Real Estate (1)

- Special Situations (1)

- Telecommunication Services (1)

- Newsletters (243)

- Pages (12)

- Recommendations (29)

- Growth (5)

- Income (8)

- Tactical Trends Portfoilio (16)

- Resource On Demand (1)

- Special Reports (75)

- Teleconferences (39)

- Webinars (2)

- The Deep Woods (2,214)

- Newsletters (2,119)

- The Deep Woods FAQ (11)

- Weekly ETF Report Videos (81)

- Q & A (34)

- Testimonial (37)

- Trusted Colleagues (16)

- Bryan Perry (4)

- Mark Skousen (7)

- Nicholas Vardy (5)

- Uncategorized (32)

- Welcome SI (1)

Search