Don’t Get Mad at the Callous-Hearted Market

COVID-19 case counts are surging in heavy populated states, including Florida, Texas and my home state of California.

Now, if you just saw the headlines reflecting the above reality this week, you would probably think that stocks were lower — and you’d be right, yet you would only be half right. The reason why is because while markets have been nervous for the past couple of weeks regarding the widespread economic reopening, the concomitant rising coronavirus infection rates and increased hospitalization rates in regions of the country that hitherto have been spared from the worst of the viral damage. Until a few days ago, the markets basically ignored the rising COVID-19 data.

The reason why markets were ignoring the data is because they are not focused on rising coronavirus numbers. Now, that’s not a description of a callous-hearted market, but rather a fact of reality.

You see, markets care about the economy. Anything that negatively influences the economy is bad for markets, and anything that doesn’t materially influence the economy largely will be ignored by markets (even if it is a global viral pandemic).

Up until a few days ago, markets were shrugging off the COVID-19 data because the rising case numbers were not seen as impeding any statewide reopening efforts. Moreover, government officials at the federal, state and local levels have been remarkably consistent, saying that unless the coronavirus numbers get significantly worse, there won’t be another widespread economic shutdown.

Then, Friday morning, Texas Gov. Greg Abbott (no fearmongering politician by any stretch of the imagination) decided to roll back some of his state’s reopening plans amid a surge of new infections. Gov. Abbott has now moved to limit restaurants to 50% capacity and require bars to close at noon except for delivery and takeout.

“At this time, it is clear that the rise in cases is largely driven by certain types of activities, including Texans congregating in bars,” Abbott said in a statement. He also said most outdoor gatherings of 100 or more people would need approval from local governments.

Now, that qualifies as a material fear of a renewed government shutdown, and hence the early Friday risk-off selling of more than 2% across the board.

The silver lining here, if there is one, is that while the increase in new coronavirus cases could delay an economic return to “normal,” the renewed fear of increasing lockdowns is going to convince markets that the multi-trillion-dollar government stimulus now on the table will be signed into law. That means an extension of unemployment benefits, other loan programs and other direct expenditures designed to shore up this COVID-19-challenged economy.

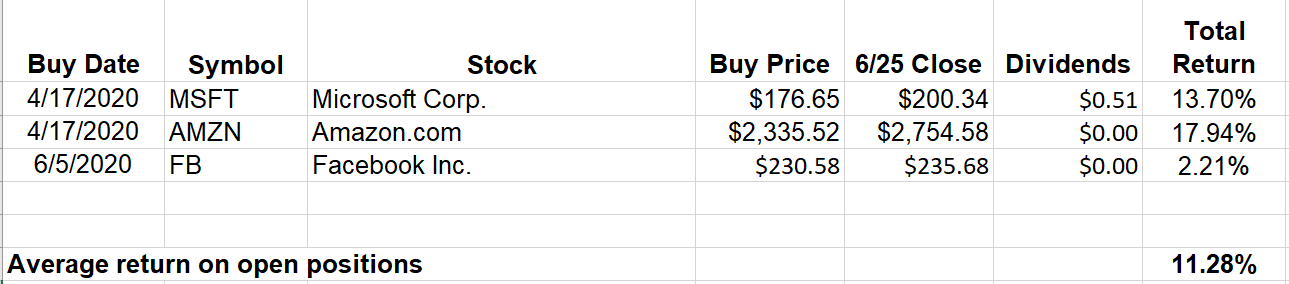

As for our holding, there has been a sustained move higher in our Tactical Trends Portfolio (TTP), as all three of our holdings continue to deliver.

Our newest position, social media giant Facebook (FB), did see some selling this week, as many high-profile companies decided to make a political statement by choosing to boycott advertising on the platform. While this is not a good development for FB, it’s also likely a temporary blip on its advertising revenue radar. The reason why is because other companies likely will fill the void. Moreover, FB has a history of making ameliorating tweaks to it platform to placate advertisers, and I suspect this time will be no different. Continue to own FB.

Finally, the best week of any year is nearly here, and it is the week in which the largest gathering of free minds takes place. That week, of course, is the week of the FreedomFest Conference, the summit for the liberty movement.

This year will undoubtedly be unlike any other at FreedomFest, and the reason why is because 2020 has been unlike any other. Sadly, freedom has become somewhat of a forbidden value during this pandemic, a value that government-friendly forces and those who want greater and greater social control have exploited for their own gain.

Yet FreedomFest gives us a chance to talk these issues out amongst those who will actually preserve, protect and defend the moral and intellectual superiority of individual liberty, individual rights and the freedom of speech and thought that’s come under such vehement assault in recent years. And just like any powerful and successful movement, we’ll do it with the love, joy, laughter, fervor and intellectual passion deserved of the primary value that makes all other values possible — the value of freedom.

So, if you want to help preserve the bedrock value that is freedom, then you need to join me at FreedomFest.

This year, FreedomFest is being held at the fabulous Caesars Palace in Las Vegas, Monday, July 13, through Thursday, July 16. Come join me and more than 200 dynamic speakers, think tanks, filmmakers, business innovators, politicians, policymakers and best-selling authors — all gathered to exchange ideas and fight for the bedrock value that allows us all to pursue our own happiness.

I guarantee you’ll have fun while also celebrating, protecting and venerating your fellow freedom warriors.

To do your part, all you have to do is sign up for FreedomFest, book your room and make those travel plans. In other words, all you have to do is put on your bravest face and stand up for the prime virtue that is freedom.

Pages

- “A Golden Vision for 2020” Conference Call 2/4/20

- About Doug Fabian’s Mutual Fund Lemon List

- About Eagle

- About Intelligence Report

- About Jim

- About the Money Charts

- Advertise

- Calendar

- Celebrating another year of success together!

- Common Functions

- Contact Us

- Disclaimer

- Disclosures & Disclaimers

- Doug’s Mutual Fund List is Arriving in 2014

- ETF Investing Articles

- Fabian’s FREE Video Series: How to Super-Charge Your Returns Using ETFs

- FAQ

- Fast Money Alert

- Follow Dick

- Get a Quote

- Getting Started with Intelligence Report

- Gmail and Hotmail Email Guidance

- Gmail and Hotmail Email Guidance for Subscribers

- Help with Successful Investing

- IC co-reg

- Important Concepts

- Instructions for AOL Users

- Issue Archive Links

- Jim Woods Investing

- Jim Woods’ Successful Investing Welcome Series

- Legal Footnote for Issues

- Login

- Login

- New Issue Notification

- Privacy Policy

- Processing Login

- Registration for this Publication is Closed

- Resources

- Retirement Compounders

- Special Reports

- Successful Investing September 2014 — FREE Issue

- Symbol Embed

- Terms of Use

- TERMS OF USE AND CONDITIONS OF SALE

- Testimonials

- Testimonials

- Thank You

- Thank You For Signing Up

- Thank You For Updating Your Information

- Unsubscribe

- Update Credit Card

- VIDEO #1: The 6 Categories of ETFs You Should Know About

- VIDEO #2: Concentration for Big Profits

- VIDEO #3: Out of Favor ETFs

- VIDEO #4: Leveraged Exchange Traded Funds

- VIDEO #5: Options 101

- Video #6: Options 201 Enhanced Securities

- Video Series: How to Super-Charge Your Profits using ETFs

- Web Tour

- Welcome to JimWoodsInvesting.com

- Woods’ Wealth Alliance

- Yerbaé Brands Corp, OTC Company Profile

- Your Account

Archives

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

Categories

- Aggressive (4)

- Eagle Eye Opener (1)

- ETF Trader's Edge (78)

- FAQ (2)

- Hotlines (68)

- Recommendations (7)

- Special Reports (1)

- FAQ (18)

- High Velocity Options PLUS (6)

- Intelligence Report (685)

- FAQ (8)

- Hotlines (367)

- Newsletters (229)

- Portfolio & Mutual Funds (6)

- Special Reports (71)

- Prime Movers (4)

- Publications (4,318)

- Bullseye Stock Trader (390)

- Crypto & Commodities Trader (32)

- High Velocity Options (199)

- Successful Investing (1,523)

- FAQ (14)

- Hotlines (1,085)

- Income Multipliers Portfolio (20)

- Consumer Discretionary (2)

- Consumer Staples (2)

- Energy (1)

- Financial (2)

- Healthcare (2)

- Industrial (5)

- Information Technology (2)

- Materials (1)

- Real Estate (1)

- Special Situations (1)

- Telecommunication Services (1)

- Newsletters (243)

- Pages (12)

- Recommendations (29)

- Growth (5)

- Income (8)

- Tactical Trends Portfoilio (16)

- Resource On Demand (1)

- Special Reports (75)

- Teleconferences (39)

- Webinars (2)

- The Deep Woods (2,214)

- Newsletters (2,119)

- The Deep Woods FAQ (11)

- Weekly ETF Report Videos (81)

- Q & A (34)

- Testimonial (37)

- Trusted Colleagues (16)

- Bryan Perry (4)

- Mark Skousen (7)

- Nicholas Vardy (5)

- Uncategorized (32)

- Welcome SI (1)

Search