Work, Play and the Fortunate Kind

This week marks the unofficial end to summer, at least from the perspective of the investment business. That’s because next week, trading desks will start to get back to full staff after the Labor Day respite on Monday.

It’s always interesting to me to see the trading volume decline in a week prior to a big holiday weekend, as most people — including the biggest money managers — have virtually “checked out” to enjoy the next 90-plus hours left before Tuesday’s opening bell.

As for me, I don’t check out, ever, because I think life should be all about the integration of work and play. To me, they’re the same thing, which means I’m always working and always playing — and that makes me a member of the fortunate kind, the kind whose work is his play and vice versa.

So, what should we expect when the rest of the world gets back to the business of trading next week?

Well, given that domestic stocks now are sitting just below all-time highs, we have to ask ourselves: what catalysts can either A) Send stocks markedly higher into the end of the year or B) Cause a significant reversal in this summer rally?

I’ll be looking at each of the following catalysts closely over the next several weeks, as the answers will start to come in fast and furious. However, today I want to simply sketch out a few highlights from the catalysts I think most likely to affect the markets for the next several months.

These catalysts are ranked in order of importance (i.e. ranked by their respective ability to cause a rally or a pullback). And, big thanks to my friend and market genius, Sevens Report editor Tom Essaye, for his advice and counsel in assessing the following catalysts.

1) U.S.-China Trade Deal. This has been the biggest catalyst on markets all year, so it’s no surprise it will continue to be the biggest catalyst going forward. If we see an actual deal between the United States and China on trade, I suspect the bulls will suck that up like an energy drink and keep running all the way to 2019. If, however, there’s no trade deal struck and more tariffs go into place, then we’ll likely see the bear break out and wrestle control away from what can certainly be considered an aging, if not downright tired, bull. Next Key Event/Date: Sept. 5, which marks the end of the “comment period” for the proposed 25% tariff on $200 billion in Chinese exports.

2) December Fed Rate Hike. There are rumblings out there that the Federal Reserve may press the pause button on a December rate hike (a September rate hike is a virtual certainty). Last week, both the Federal Open Market Committee (FOMC) minutes and a speech by Fed Chair Powell had slightly “dovish” tones, and there is a growing expectation (but not consensus) that the Fed will pause for a bit after the September hike. If the Fed does press the pause button in December, it will be viewed as a positive for the bulls. Key Event/Date: Sept. 26, the next Fed meeting, which should give us clues about a December hike.

3) U.S. Dollar. The rising value of the U.S. dollar vs. rival foreign currencies has become a headwind for stocks of late, and that’s because if the dollar keeps rising it will pressure Q3 corporate earnings as well as global growth. If we see the dollar start to come back down, that will be a positive for equities. If, however, the dollar keeps pushing higher, that will strengthen the headwinds… and that could finally trip up the bulls.

4) Q3 Earnings Season. Above all else, the 2018 rally has been primarily earnings-driven. That means that for stocks to continue pushing higher, earnings must continue to grow. If that doesn’t happen, and if earnings start to get pressured for any reason (stronger dollar, lack of economic momentum, tariffs, etc.) then this market will develop a valuation problem, and that could take stocks down quickly. Next Key Event/Date: Oct. 8, the first week of the Q3 reporting season.

5) Midterm Elections. If I must put on my political hat (a hat I prefer to leave in the closet), I am forced to conclude that the midterm elections will likely result in a split Congress (Democrats in control of the House, Republicans in control of the Senate and the White House) and a stalemated government. That’s a good thing for markets, historically speaking; however, today’s political environment is nothing if not a historical anomaly. If the political headlines surrounding President Trump and the Mueller investigation begin to look dire for the administration, then we could see political drama that even the most intrepid bulls would find difficult to escape. Next Key Event/Date: Election Day, Nov. 6.

Again, I’ll have more on each of these catalysts in the hotlines and in our monthly newsletter. For now, know that I will be watching each of these potential catalysts closely to help us determine the next direction for stocks now that the summer trading season is over.

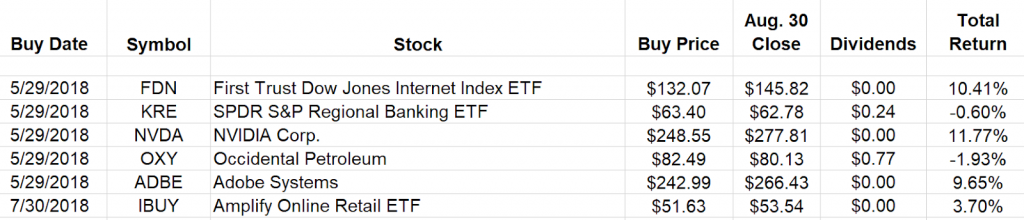

As the summer comes to a close, we are sitting on some great gains in the TTP portfolio. We now have double-digit-percentage gains in the First Trust Dow Jones Internet Index ETF (FDN) and NVIDIA Corp. (NVDA), as well as a near-double-digit-percentage gain in Adobe Systems (ADBE).

Finally, I hope you have a tremendous weekend. I know I plan to do what I do best this Labor Day — and that is to combine work and play such that there is zero distinction between the two.

Pages

- “A Golden Vision for 2020” Conference Call 2/4/20

- About Doug Fabian’s Mutual Fund Lemon List

- About Eagle

- About Intelligence Report

- About Jim

- About the Money Charts

- Advertise

- Calendar

- Celebrating another year of success together!

- Common Functions

- Contact Us

- Disclaimer

- Disclosures & Disclaimers

- Doug’s Mutual Fund List is Arriving in 2014

- ETF Investing Articles

- Fabian’s FREE Video Series: How to Super-Charge Your Returns Using ETFs

- FAQ

- Fast Money Alert

- Follow Dick

- Get a Quote

- Getting Started with Intelligence Report

- Gmail and Hotmail Email Guidance

- Gmail and Hotmail Email Guidance for Subscribers

- Help with Successful Investing

- IC co-reg

- Important Concepts

- Instructions for AOL Users

- Issue Archive Links

- Jim Woods Investing

- Jim Woods’ Successful Investing Welcome Series

- Legal Footnote for Issues

- Login

- Login

- New Issue Notification

- Privacy Policy

- Processing Login

- Registration for this Publication is Closed

- Resources

- Retirement Compounders

- Special Reports

- Successful Investing September 2014 — FREE Issue

- Symbol Embed

- Terms of Use

- TERMS OF USE AND CONDITIONS OF SALE

- Testimonials

- Testimonials

- Thank You

- Thank You For Signing Up

- Thank You For Updating Your Information

- Unsubscribe

- Update Credit Card

- VIDEO #1: The 6 Categories of ETFs You Should Know About

- VIDEO #2: Concentration for Big Profits

- VIDEO #3: Out of Favor ETFs

- VIDEO #4: Leveraged Exchange Traded Funds

- VIDEO #5: Options 101

- Video #6: Options 201 Enhanced Securities

- Video Series: How to Super-Charge Your Profits using ETFs

- Web Tour

- Welcome to JimWoodsInvesting.com

- Woods’ Wealth Alliance

- Yerbaé Brands Corp, OTC Company Profile

- Your Account

Archives

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

Categories

- Aggressive (4)

- Eagle Eye Opener (1)

- ETF Trader's Edge (78)

- FAQ (2)

- Hotlines (68)

- Recommendations (7)

- Special Reports (1)

- FAQ (18)

- High Velocity Options PLUS (6)

- Intelligence Report (685)

- FAQ (8)

- Hotlines (367)

- Newsletters (229)

- Portfolio & Mutual Funds (6)

- Special Reports (71)

- Prime Movers (4)

- Publications (4,318)

- Bullseye Stock Trader (390)

- Crypto & Commodities Trader (32)

- High Velocity Options (199)

- Successful Investing (1,523)

- FAQ (14)

- Hotlines (1,085)

- Income Multipliers Portfolio (20)

- Consumer Discretionary (2)

- Consumer Staples (2)

- Energy (1)

- Financial (2)

- Healthcare (2)

- Industrial (5)

- Information Technology (2)

- Materials (1)

- Real Estate (1)

- Special Situations (1)

- Telecommunication Services (1)

- Newsletters (243)

- Pages (12)

- Recommendations (29)

- Growth (5)

- Income (8)

- Tactical Trends Portfoilio (16)

- Resource On Demand (1)

- Special Reports (75)

- Teleconferences (39)

- Webinars (2)

- The Deep Woods (2,214)

- Newsletters (2,119)

- The Deep Woods FAQ (11)

- Weekly ETF Report Videos (81)

- Q & A (34)

- Testimonial (37)

- Trusted Colleagues (16)

- Bryan Perry (4)

- Mark Skousen (7)

- Nicholas Vardy (5)

- Uncategorized (32)

- Welcome SI (1)

Search